Project Risk Management Plan – Delivering Projects with Confidence: A Practical, PMI-RMP-Aligned Guide to Project Risk Management

1. Why Risk Management Is Your Project’s Silent Power Source

Projects hardly ever derail because people lack talent or dedication; they derail because the unknowns were not managed early enough.

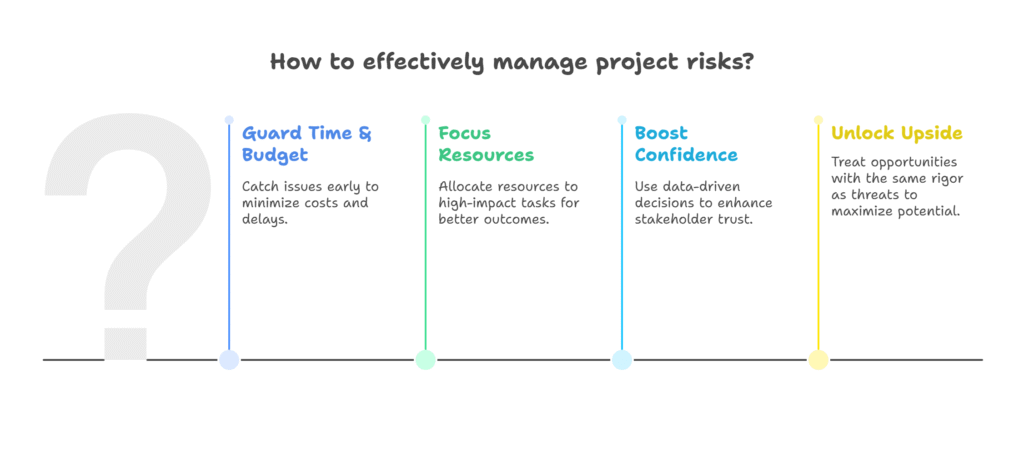

Risk management is the discipline that turns those unknowns into actionable foresight. When done well it will:

- Guard time & budget issues are caught when they are cheapest to fix.

- Focus resources on the work that profoundly moves the needle.

- Boost stakeholder confidence with transparent, data-driven decisions.

- Unlock upside by treating opportunity risks with the same rigor as threats.

Bottom line: mastering risk management is the fastest path to predictable delivery and the PMI-RMP credential proves you can lead that charge.

2. Inside the PMI-RMP Credential

| Quick Facts | Details |

| Audience | Project Managers / Risk Managers / Functional Managers / C-Suite Executives who lead risk effort |

| Exam | 115 Qs (15 unscored) • 2.5 hrs • 5 domains |

| Core Domains | Risk Strategy & Planning • Risk Identification • Risk Analysis • Risk Response • Monitor and Close Risks |

| Check PMI Site for More Details | Risk Management Professional (PMI-RMP) Certification | PMI |

Why pursue it?

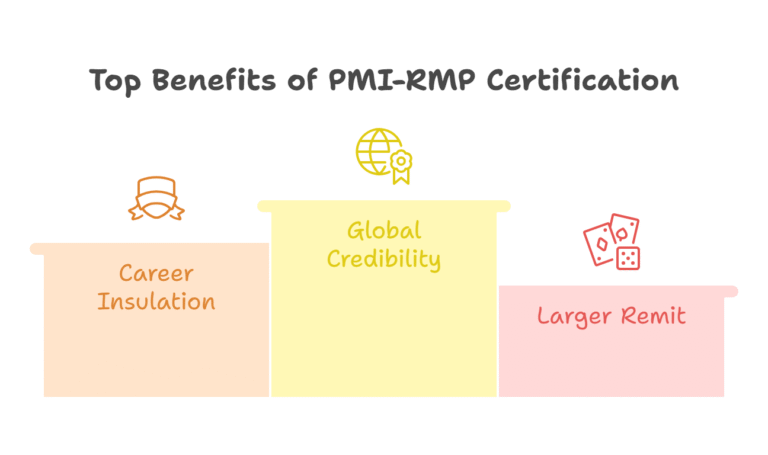

- Global credibility: PMI certifications are HR’s gold standard.

- Career insulation: you are the go-to problem spotter & solver.

- Larger remit: organizations entrust RMPs with complex, high-stakes initiatives.

3. Big-Picture Benefits of a Robust Risk Practice

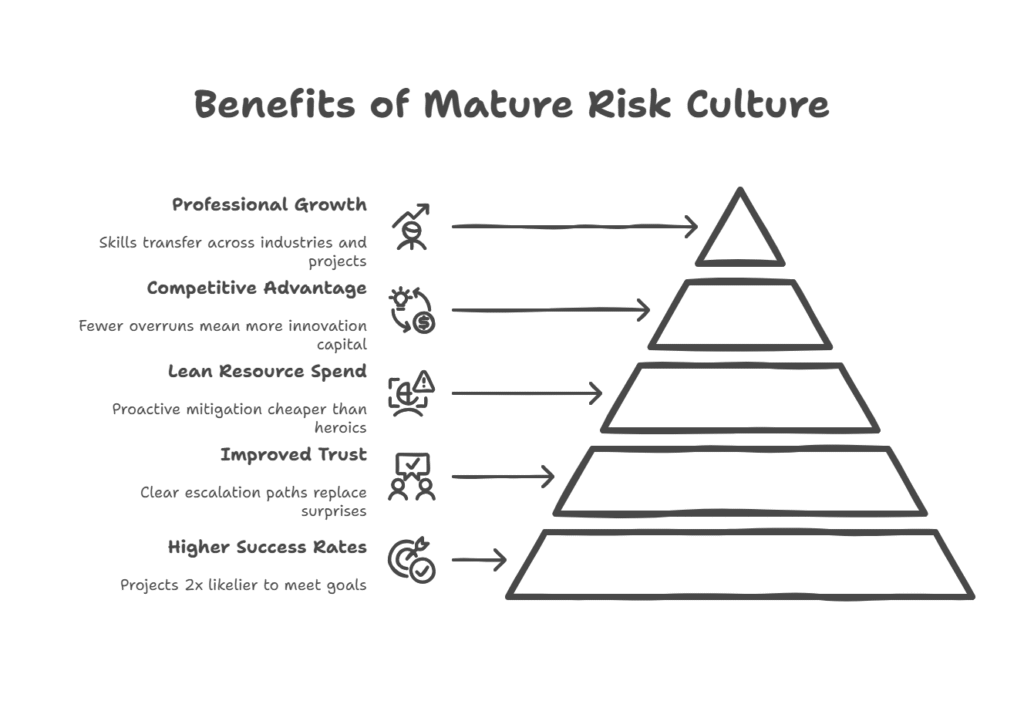

- Higher success rates: PMI’s Pulse data show projects with mature risk cultures are 2× likelier to meet goals.

- Improved stakeholder trust: clear escalation paths replace surprise fire-drills.

- Lean resource spend initiative-taking mitigation is cheaper than last-minute heroics.

- Competitive advantage: fewer overruns mean more capital for innovation.

- Professional growth: the skill transfers across industries, markets, project types.

4. The PMI-RMP’s Role on a Project Team

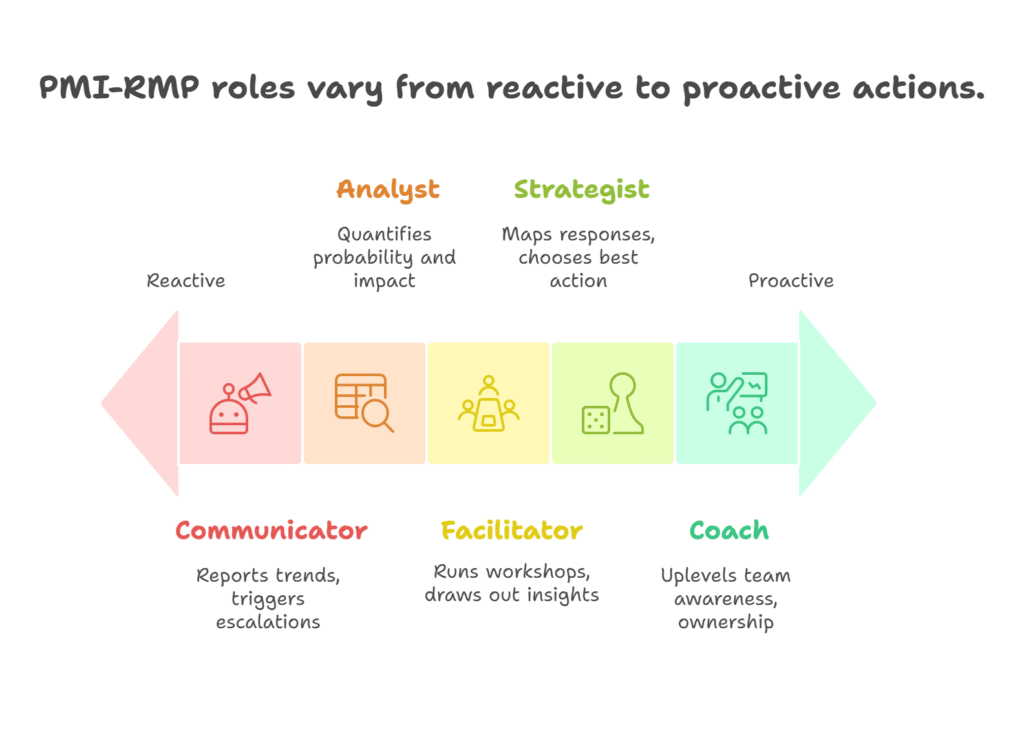

| Hat, You Wear | Real-World Actions |

| Facilitator | Run risk workshops, draw out cross-functional insights |

| Analyst | Quantify probability/impact, build risk matrices & Monte Carlo sims |

| Strategist | Map responses: avoid, transfer, mitigate, accept, exploit |

| Coach | Uplevel the team’s awareness & ownership of risk |

| Communicator | Report exposure trends to sponsors, trigger escalations early |

5. Core Concepts Every Risk Professional Must Nail

5.1 Risk vs. Risk Management

| Term | Meaning |

| Risk | Anything uncertain that can help or hurt objectives |

| Threat | A negative risk: delays, cost blowouts, quality hits |

| Opportunity | A positive risk: faster delivery, cost savings, extra scope at no cost |

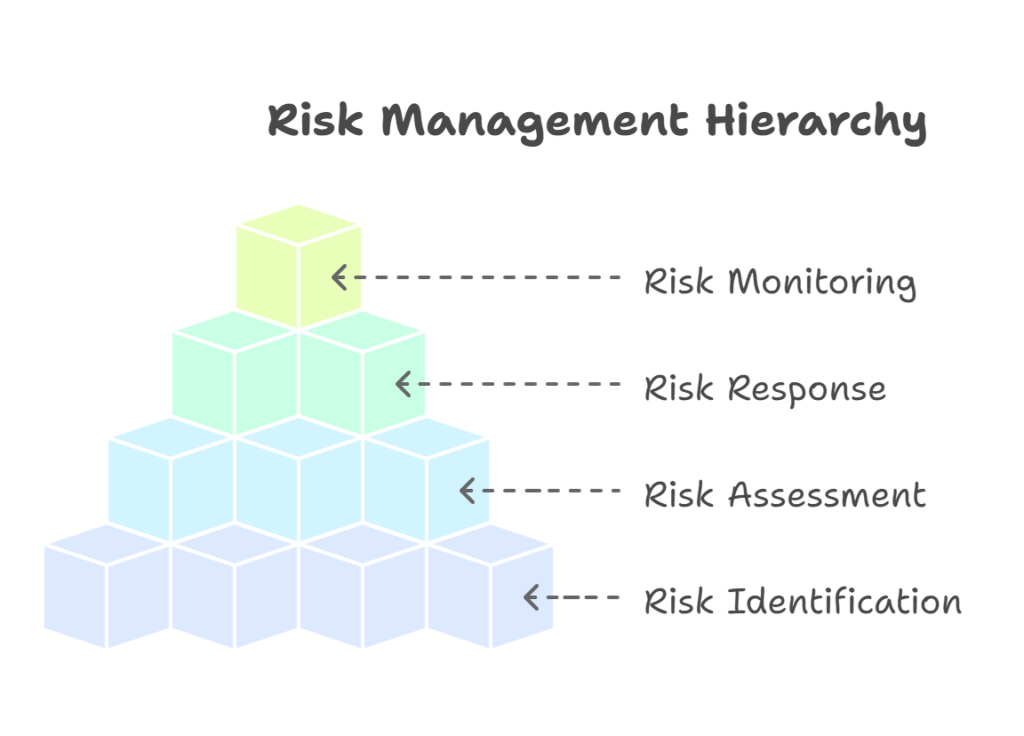

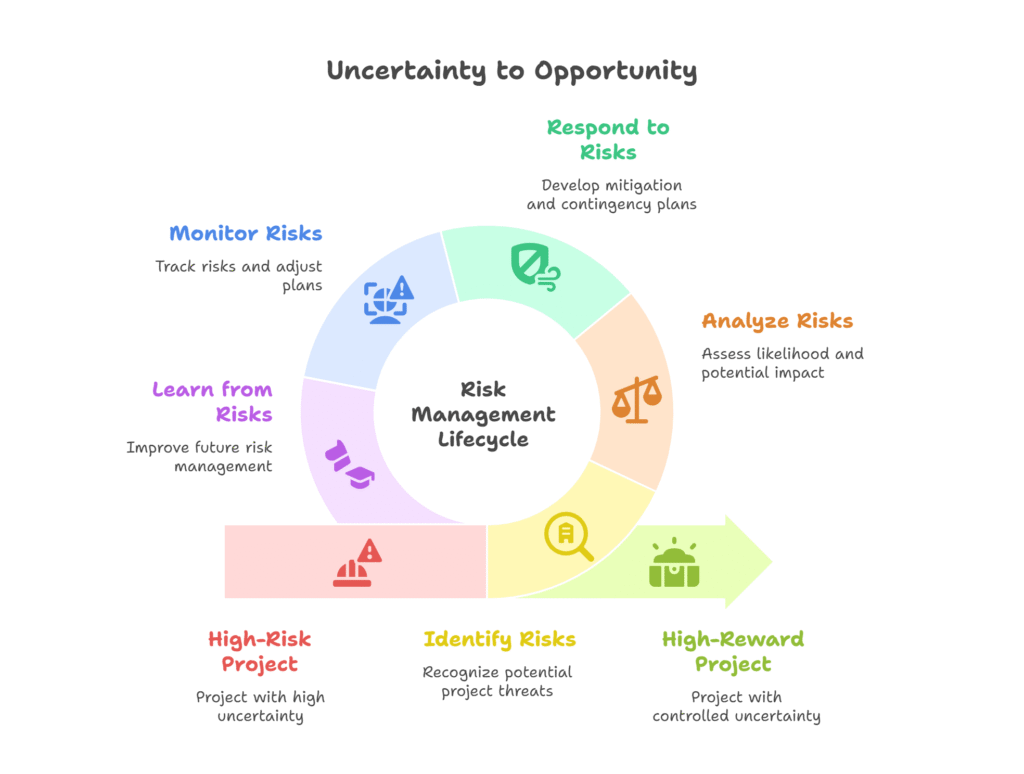

| Risk Management | The structured loop of identify → analyse → plan → act → monitor |

5.2 Risk Identification Techniques

- Brainstorming sessions (diverse voices = richer risk log)

- SWOT & PESTLE to scan external forces.

- Checklists from past projects & industry databases

- Assumption analysis what if critical assumptions prove false?

- Delphi surveys for anonymous expert consensus

- Lessons-learned repository mining

Tip: log everything first, filter later, early breadth prevents blind spots.

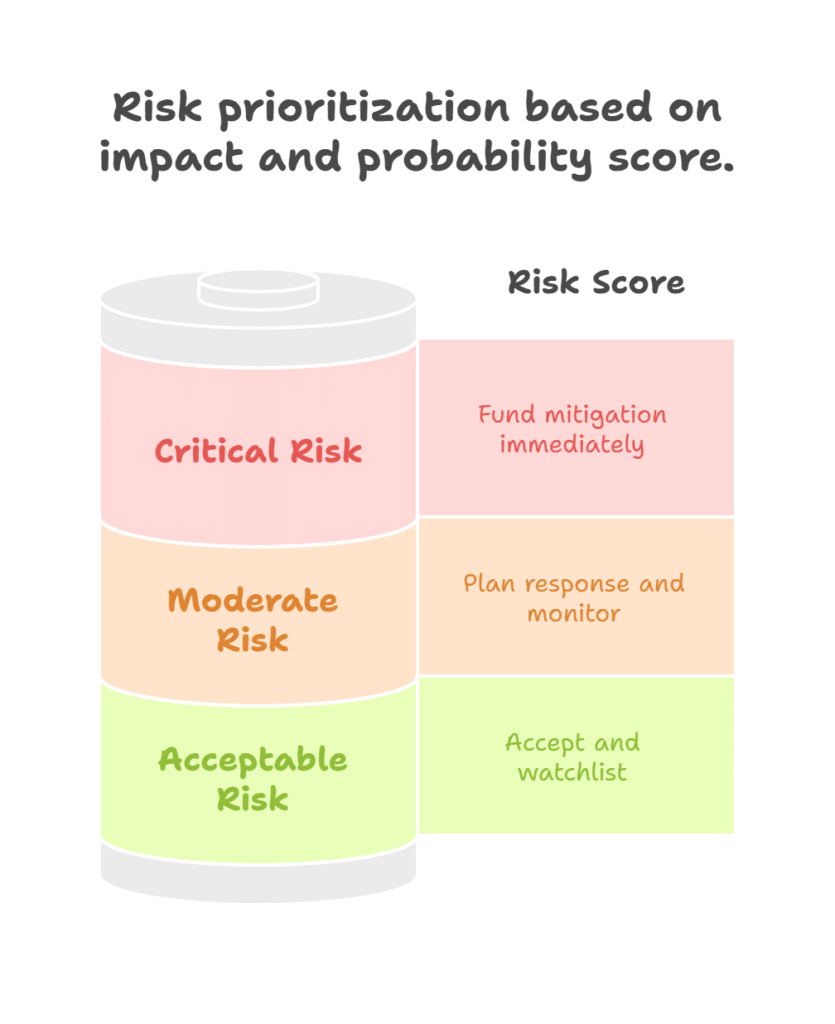

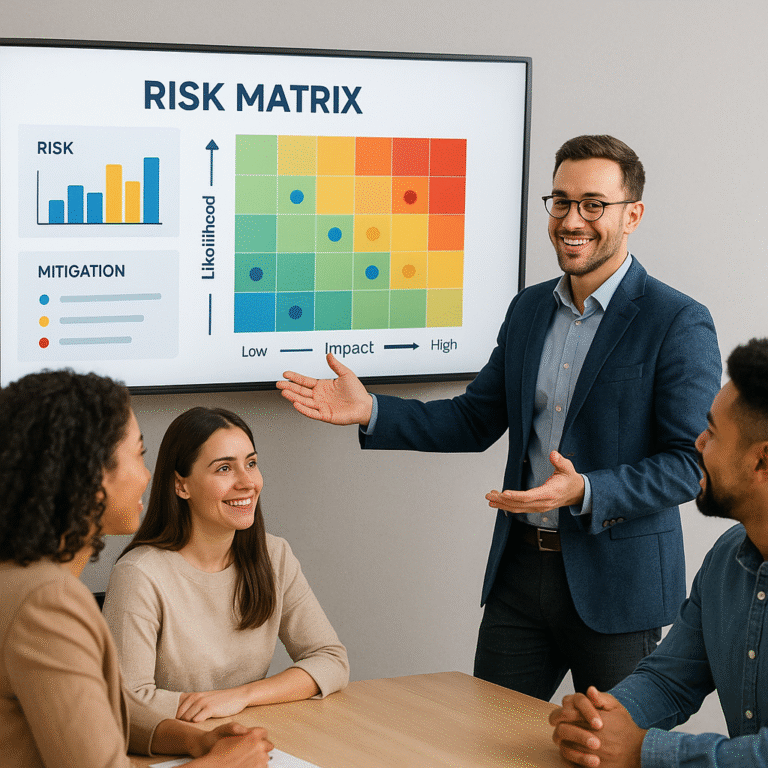

5.3 Risk Assessment & Prioritization

- Qualitative pass

- Rate probability (1-5) and impact (1-5).

- Visualize on a heat matrix, reds demand action now.

- Quantitative deep dive (for top threats)

- Expected Monetary Value (EMV) = probability × cost impact.

- Monte Carlo simulation for schedule or cost range forecasting.

- Prioritize resources to the critical few (typically top 10-20 %).

5.4 Risk Response Strategies

| Category | Tactic | Example |

| Avoid | Remove trigger | Eliminate feature that depends on unstable API |

| Transfer | Shift liability | Purchase warranty or contractual penalty clause |

| Mitigate | Lower P or I | Add automated test suite to catch defects sooner |

| Accept | Document & monitor | Minor UI colour clash will not impact users |

| Exploit | Maximize upside | Early beta opens new revenue stream |

| Enhance | Raise likelihood | Fast-track patent filing to secure market lead |

5.5 Risk Monitoring & Control

- Dashboards exposure $, heat map trend, mitigation burn rate.

- Trigger thresholds if risk score rises > 3 points, auto-escalate.

- Regular cadences weekly in agile, monthly in predictive life cycles

- Lessons-learned loop feed outcomes into the next risk cycle

6. Building Your Risk Management Plan (RMP)

A living blueprint tying the entire process together.

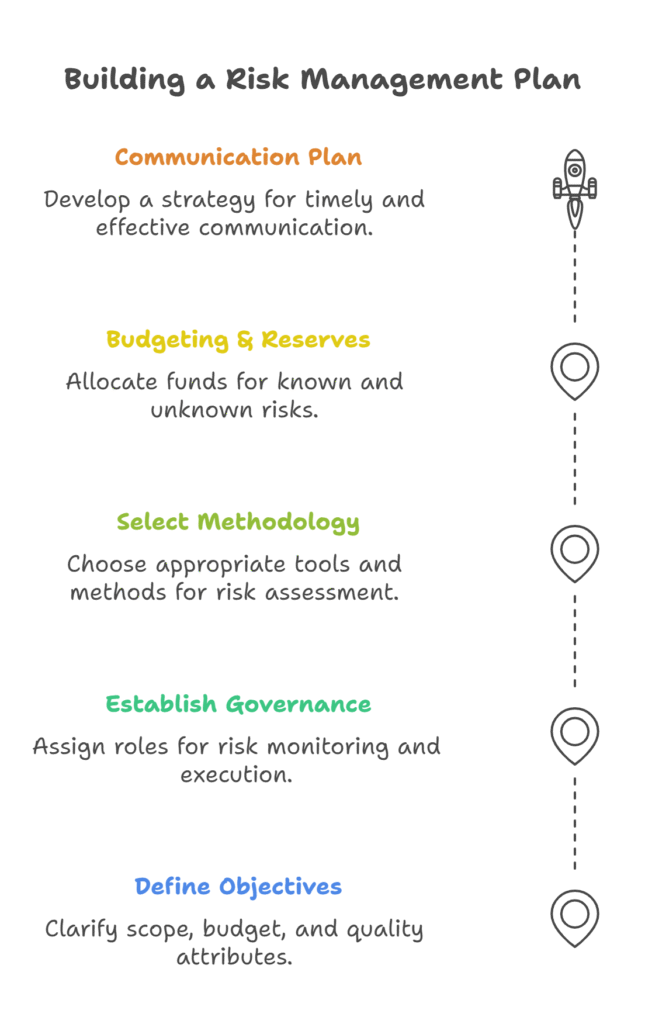

6.1 Define Objectives & Tolerance

- Clarify scope, budget, critical quality attributes.

- Agree on “red lines” (non-negotiables) with sponsors e.g., no more than ±5 % budget variance.

6.2 Establish Governance & Roles

- Risk owner monitors assigned risk, drives response.

- Risk actioner executes mitigation tasks.

- Sponsor clears funding/roadblocks.

- PMO audits process health.

6.3 Select Methodology & Tools

- Scales (1-5 or 1-10)

- Probability/impact matrix design

- Quant methods to be used (EMV, Monte Carlo)

- Tool stack (Excel, SharePoint, Planview, Jira plug-ins)

6.4 Budgeting & Reserves

| Reserve Type | Purpose |

| Contingency | Known unknowns (in baseline) |

| Management | Unknown unknowns (held by exec sponsor) |

6.5 Communication Plan

- Who gets what? Sponsor summary vs. team-level details.

- How often? Weekly digest, phase-gate report, ad-hoc alert

- Channels? Dashboards, email, stand-ups, steering committee packs

7. Risk Identification in Action

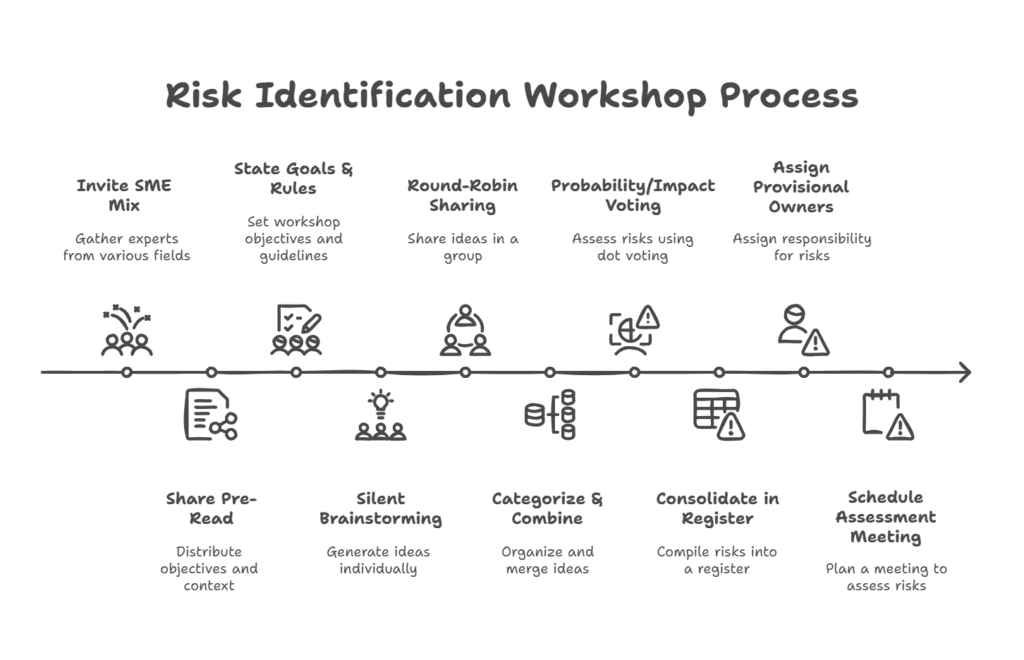

Step-by-step workshop recipe

- Prep

- Invite SME mix (technical, legal, ops, vendor).

- Share pre-read: objectives, context, prior risk logs.

- Session (90 min)

- 10 min: state goals & rules (all ideas welcome).

- 40 min: silent brainstorming → round-robin sharing.

- 30 min: categorize & combine duplicates.

- 10 min: quick probability/impact voting with dots.

- Post-session

- Consolidate in register.

- Assign provisional owners.

- Schedule assessment meeting.

8. Assessing & Prioritizing

8.1 Fast Qualitative Scoring Grid

| Impact ↓ / Probability → | 1 Very Low | 2 Low | 3 Med | 4 High | 5 Very High |

| 5 Critical | 5 | 10 | 15 | 20 | 25 |

| 4 Major | 4 | 8 | 12 | 16 | 20 |

| 3 Moderate | 3 | 6 | 9 | 12 | 15 |

| 2 Minor | 2 | 4 | 6 | 8 | 10 |

| 1 Negligible | 1 | 2 | 3 | 4 | 5 |

- Score ≥15? -> Red → fund mitigation immediately.

- Score 6-12? -> Amber → plan response, monitor.

- Score ≤5? -> Green → accept & watchlist.

8.2 Quant Tricks for Priority 1 Risks

- Three-point estimate (Best, Most Likely, Worst) for EMV.

- @Risk or Primavera Risk Analysis plug-ins for Monte Carlo, 1,000+ iterations give a probabilistic cost or schedule S-curve.

- Sensitivity tornado charts to see which risks drive 80 % of exposure focus there.

9. Crafting & Executing Responses

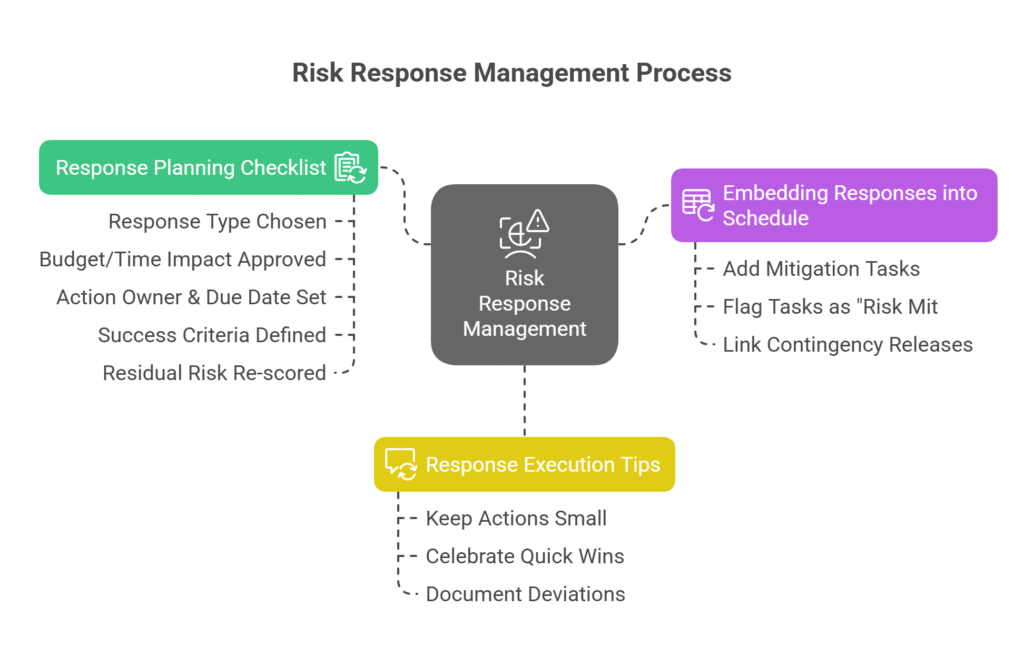

9.1 Response Planning Checklist

- ☐ Response type chosen & justified

- ☐ Budget/time impact approved

- ☐ Action owner and due date set

- ☐ Success criteria defined (probability cut from 0.6 → 0.2, etc.)

- ☐ Residual risk re-scored

9.2 Embedding Responses into the Schedule

- Add mitigation tasks with predecessors & resource assignments.

- Flag tasks as “Risk Mit” in WBS for easy filtering.

- Link contingency releases to tangible triggers (e.g., design sign-off).

9.3 Response Execution Tips

- Keep actions small & time-boxed momentum beats perfection.

- Celebrate quick wins; visible progress sustains buy-in.

- Document deviations great fodder for lessons learned and audit trail.

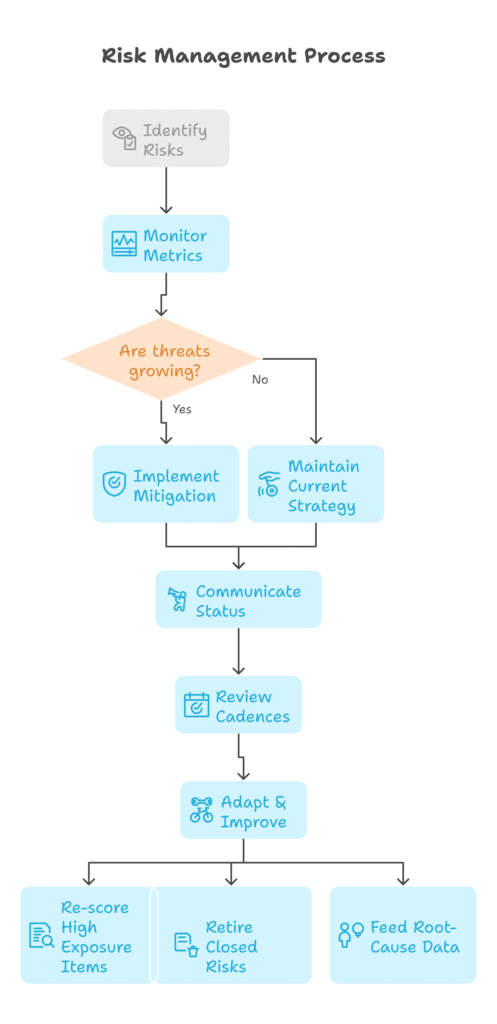

10. Monitoring, Controlling & Communicating

10.1 Metrics That Matter

| Metric | What It Tells You |

| Open-risk count (red/amber) | Are threats growing or shrinking? |

| Mitigation velocity | % of planned responses completed on time |

| Contingency draw-down | How fast are we burning our buffer? |

| Issue conversion rate | How many risks turned into significant issues? |

10.2 Cadences

- Weekly – team stand-up: new risks, status colour-swap.

- Monthly – steering committee: exposure trend, approvals.

- Phase-gate – update risk baseline; decide funding top-ups.

10.3 Adapt & Improve

- Re-score high exposure items every cycle.

- Retire closed risks, archive evidence.

- Feed root-cause data into organizational lessons-learned.

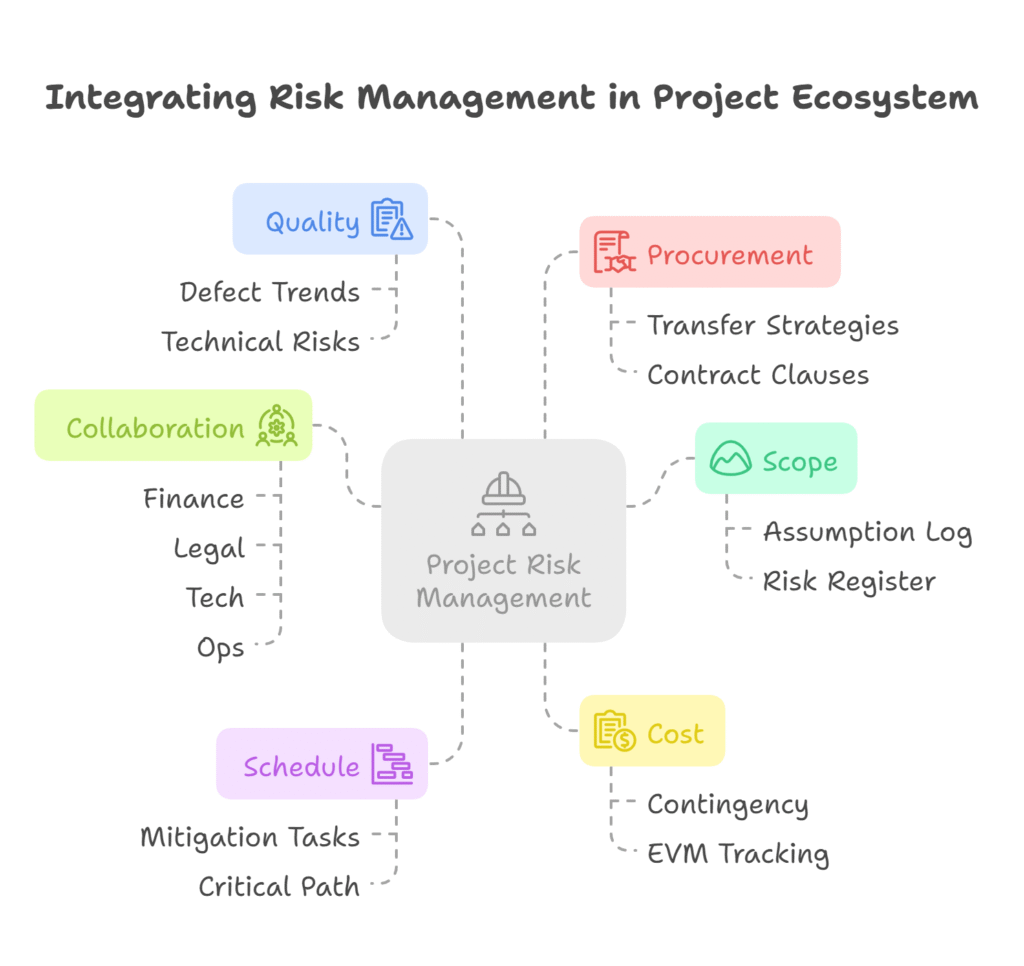

11. Integrating Risk with the Wider PM Ecosystem

| PM Process | Risk Touchpoint |

| Scope | Assumption log feeds risk register. |

| Schedule | Mitigation tasks extend critical path? adjust float. |

| Cost | Contingency embedded in baseline, tracked in EVM. |

| Quality | Defect trends can trigger new technical risks. |

| Procurement | Transfer strategies formalized via contract clauses. |

Collaboration is king: finance, legal, tech, and ops all influence and are influenced by project risk.

12. Mini Case Study: Turning Compliance Chaos into a Competitive Win

Industry: FinTech

Problem: New regulation threatened $5 M penalties.

Approach:

- Identified 42 regulatory-change risks in a 3-hour SME workshop.

- Quantified “worst case” cost via EMV = $1.2 M.

- Allocated $200 k mitigation budget; top actions embedded in sprint backlog.

Outcome: - 96 % of requirements implemented 2 months early.

- Audit cycle time cut by 66 %.

- Company spun compliance readiness into a marketing differentiator netting three enterprise clients.

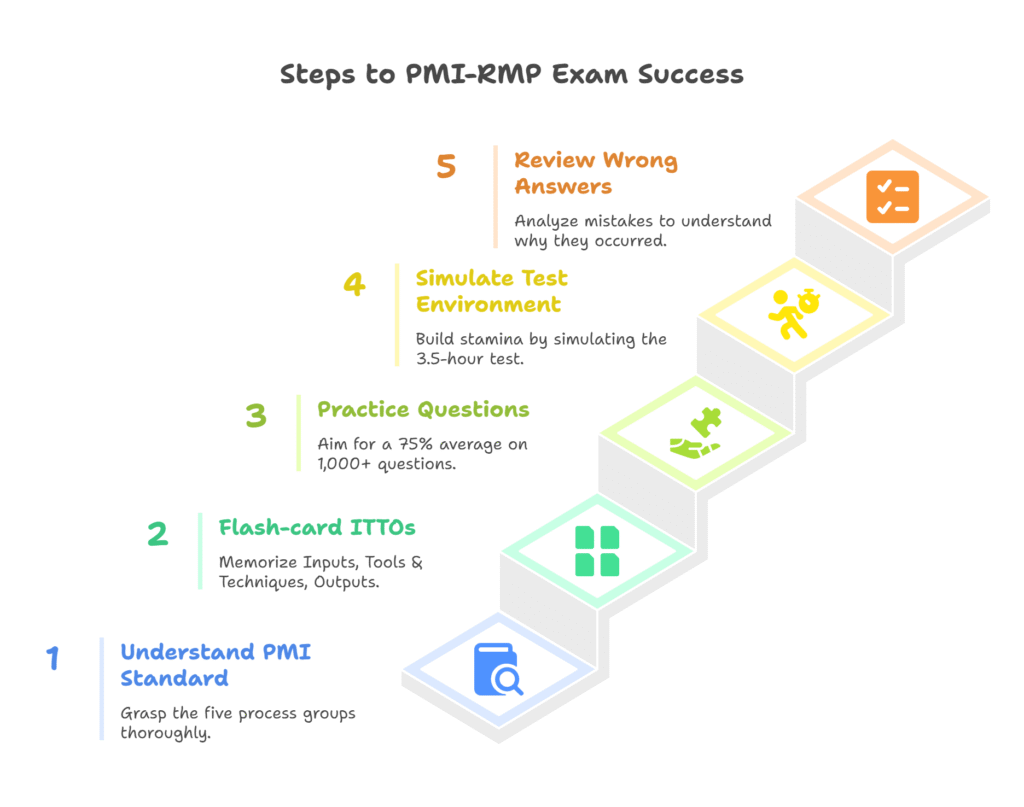

13. PMI-RMP Exam Prep Cheat Sheet

- Start with the PMI “Standard for Risk Management” know the five process groups cold.

- Flash-card ITTOs Inputs, Tools & Techniques, Outputs.

- Practice 1,000+ questions shoot for 75 % average.

- Simulate the 3.5-hour test environment manage stamina.

- Review every wrong answer focus on why you missed it.

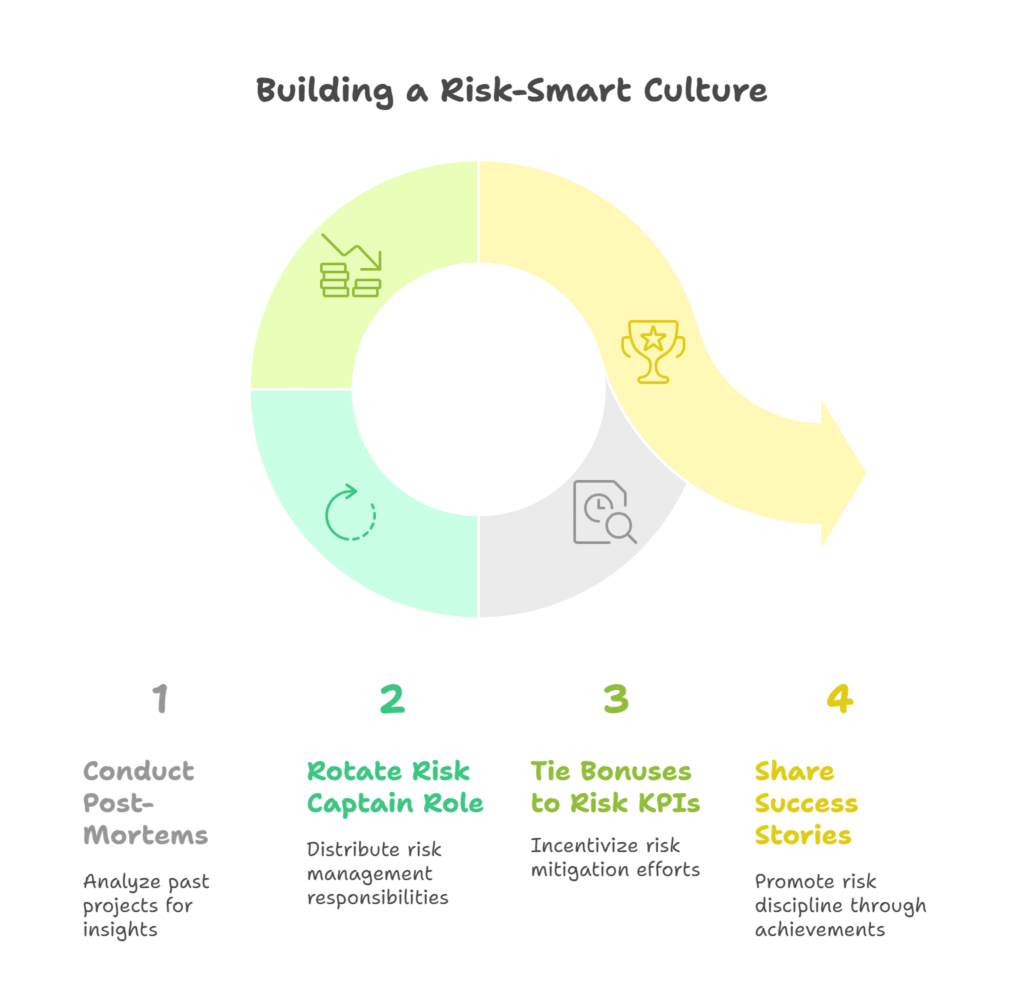

14. Continuous Improvement: Building a Risk-Smart Culture

- Post-mortems = gold mines make them blameless, fact-based, actionable.

- Rotate “Risk Captain” role across team members to spread knowledge.

- Tie performance bonuses partly to risk KPIs (e.g., mitigation completion rate).

- Share success stories across the org nothing sells risk discipline like visible wins.

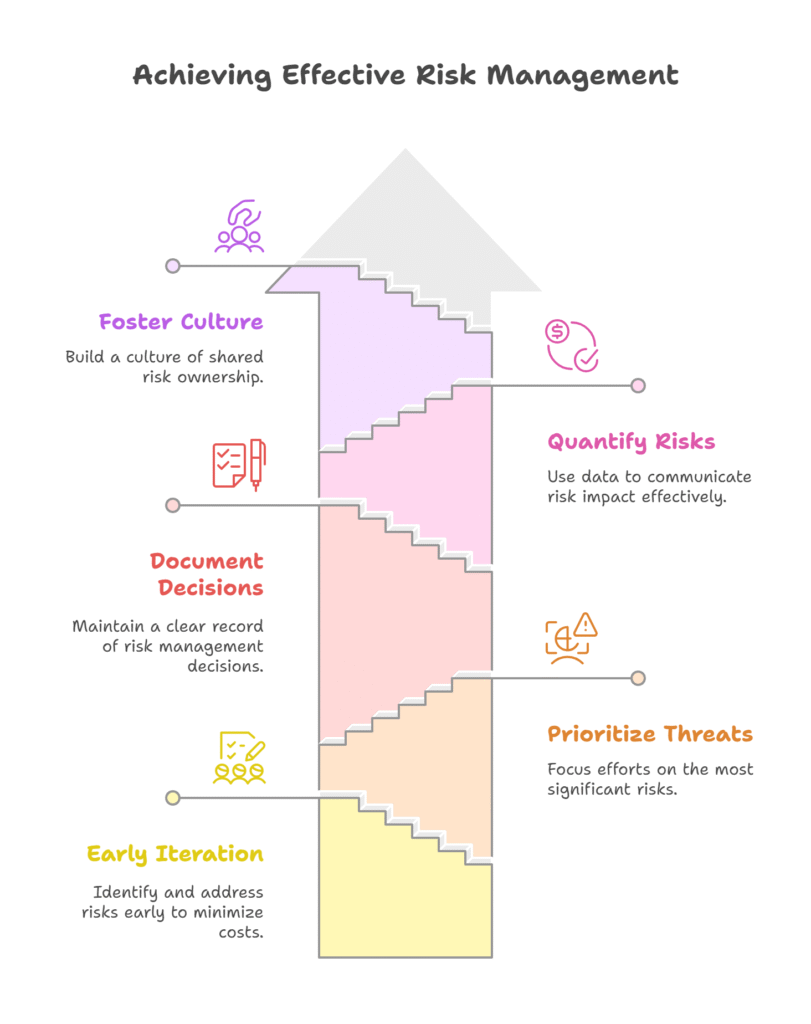

15. Key Takeaways

- Start early, iterate often. The sooner risks surface, the cheaper the fix.

- Prioritize ruthlessly. Focus 80 % of effort on the top 20 % threats.

- Document decisions. A transparent trail saves arguments later.

- Quantify to persuade. Dollars and days win executive minds faster than colours.

- Culture beats process. Tools help; shared ownership delivers.

Ready to Deliver with Confidence?

Whether you are studying for the PMI-RMP or levelling up your day-to-day delivery game, embed this lifecycle identify → analyse → respond → monitor → learn and watch uncertainty turn into opportunity.

Now go transform your next project from high-risk to high reward.

References

- PMI Pulse of the Profession 2015 – High-Performing Organizations Project Management Institute

- Stakeholder-Centric Risk & Project Success (PMI) Project Management Institute

| Lifecycle Stage | Key Levers you can Adjust | Illustrative Scenario (one per risk category) | Why / What You Assess |

| 1. Risk Strategy & Planning | • Define risk appetite scale (cost %, time %, defect density) • Choose governance cadence (weekly PRC, monthly PSC) • Allocate contingency reserves • Select tooling (ServiceNow IRM vs Jira plug-ins) | Technical – Decide whether to target 99.95 % or 99.99 % uptime for a SaaS cut-over. Compliance – Commit to “no high-severity vulnerabilities at go-live.” | Test alignment between appetite, budget, and delivery ambition. |

| 2. Risk Identification | • Workshop formats (brainstorm, premortem, Delphi) • Taxonomy depth (high-level vs granular) • Stakeholder lenses (IT, Ops, Legal, Finance) | Legal – Premortem reveals open-source licence conflicts in a micro-service slated for production. Operational – Gemba walk uncovers single-person knowledge silo in batch-job recovery. | Ensures a complete, bias-reduced risk register. |

| 3. Qualitative/Quantitative Analysis | • Scoring matrix weightings (P×I, with or w/o detectability) • Monte-Carlo settings (# iterations, PERT ranges) • Decision-tree vs Tornado chart depth | Financial – Monte-Carlo shows P90 budget overrun of +11 %, breaching the +8 % appetite. Strategic – Tornado chart ranks AI-feature delay as top contributor to NPV loss. | Converts raw risks into prioritised, data-backed focus items. |

| 4. Risk Response | • Strategy selection (Avoid, Mitigate, Transfer, Accept) • Funding trigger points (e.g., drawdown at RPN ≥ 7) • SLA / contract clauses for transfer | Technical – Avoid go-live clash by re-sequencing release calendar. Compliance – Transfer potential PCI fines via cyber-insurance rider. | Balances cost of action vs cost of exposure. |

| 5. Monitor & Control | • KRI thresholds (e.g., latency > 1 s, backlog > 20 tickets) • Dashboard frequency • Audit sampling size • Escalation rules (24 h vs 72 h) | Operational – Real-time KRIs flag 3PL API latency spike, triggering vendor escalation. Public-Perception – Social-listening tool shows 20 % rise in negative sentiment post-migration. | Keeps live view of residual exposure; validates effectiveness of responses. |

| 6. Closure & Lessons Learned | • Exit criteria (variance < 0.1 %, zero Sev-1 for 30 days) • Retrospective format (blameless RCA, AAR) • Knowledge-base tagging | Technical – Close outage-risk once dual-data-centre replication runs for 60 days without failover. Compliance – Close GDPR-risk after external audit attestation letter received. | Ensures organisational learning and prevents risk re-entry. |

Grab your copy of Mastering PMP® Certification for IT Professionals and unlock access to the full digital product!

Want a sneak peek? Visit Grow exponentially with Techno Evangelist for a free preview.

Thanks for reading the article “Project Risk Management Plan” and read all articles on Project Management